- Home

- Manufacturing

- Historical Leading Manufacturer of High-Precision Machinery

Historical Leading Manufacturer of High-Precision Machinery

© 2026 MergersCorp M&A International.

© 2025 MergersCorp M&A International is a global brand operating through a number of professional firms and constituent entities (“Members”) located throughout the world to provide Investment Banking, Corporate Finance, and Advisory Services and other client-related professional services. The Member Firms (“Members”) are constituted and regulated in accordance with relevant local regulatory and legal requirements. For more details on the nature of our affiliation, please visit our Disclaimer: https://mergerscorp.com/disclaimer. MergersCorp M&A International's franchising program is not offered to individuals or entities located in the United States.

The franchising program is offered by MergersUK Limited, a UK Company with its registered office at 71-75 Shelton Street, Covent Garden, London, WC2H 9JQ, United Kingdom.

MergersCorp M&A International provides strategic business advisory services, including preparing companies for growth and capital access. Through partnerships with licensed investment bankers, clients can access tailored capital-raising solutions.

U.S. Investment Banking Securities transactions are exclusively conducted by Spektrum Capital Advisors LLC, a Registered Representative of, and Securities Products offered through, BA Securities, LLC, a FINRA-registered broker-dealer. Check the background of investment professionals associated with this site on Broker Check.

Historical Leading Manufacturer of High-Precision Machinery

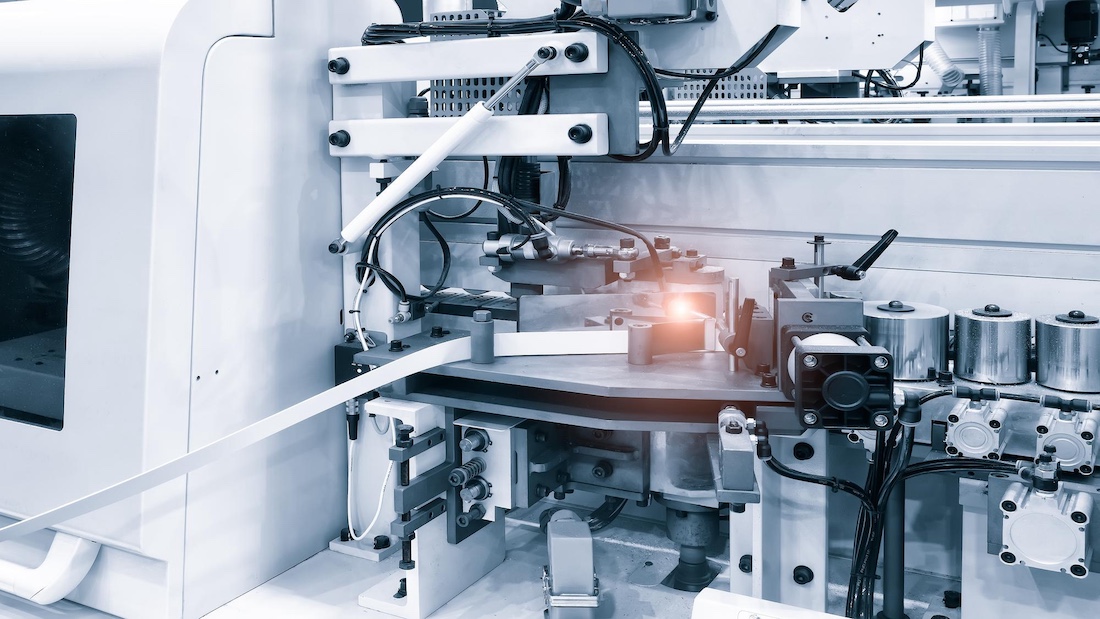

This represents the opportunity to acquire a world-leading, innovative manufacturer of high-precision machinery for the hygiene and medical sectors. Based in the Swiss, the company specializes in complete infrastructure for tampon and wound care production, supported by over six decades of industry expertise.

The company is a specialist in highspeed nonwoven converting systems, serving the medical, pharma, life science, and hygiene industries. It acts as an end-to-end solution provider by covering the entire value chain:

-

Machinery: Production of state-of-the-art tampon and wound care machines featuring high throughput and low waste.

-

After-Sales & Services: Comprehensive support including planning, installation, maintenance, repairs, and training.

-

Parts & Digital: Provision of spare parts and evolving digital services to ensure long-term client partnerships.

Market Position & Competitive Advantage

-

Global Leadership: Recognized as a niche world leader with a track record of delivering high-quality production solutions for over 60 years.

-

Innovation Excellence: Maintains a highly skilled workforce with a significant focus on Research & Development.

-

New Technology: Recently developed the TMX machine, a highly efficient system designed to significantly boost productivity.

-

Client Base: Diversified portfolio including private label manufacturers and significant potential for OEM partnerships.

Market Opportunity

-

Market Growth: The global tampon market is valued at over USD 1.5 billion, with an expected CAGR of 4.75%, reaching USD 1.9 billion by 2027.

-

Growth Drivers: Demand is fueled by global population expansion, increased emphasis on personal hygiene, and rapid growth in emerging markets.

-

Strategic Expansion: The company is well-positioned to leverage its international network to capture increased demand in these growing markets.

About

Resources

Contacts

M&A Deal Advisory

Corporate Finance

- Strategic advisory

- SPAC Advisory Service

- Financing and IPOs

- Due Diligence

- Corporate Administration

- Corporate Restructuring

- Debt Restructuring

- Equity Restructuring

- Bridge Financing

- Art Finance & Luxury Asset Loans

- International finance consulting

- Project finance consulting

- Bonds / Actively Managed Certificates (AMCs)

- Succession Planning

- M&A Sports & Football

Consulting

© 2025 MergersCorp M&A International is a global brand operating through a number of professional firms and constituent entities (“Members”) located throughout the world to provide Investment Banking, Corporate Finance, and Advisory Services and other client-related professional services. The Member Firms (“Members”) are constituted and regulated in accordance with relevant local regulatory and legal requirements. For more details on the nature of our affiliation, please visit our Disclaimer: https://mergerscorp.com/disclaimer. MergersCorp M&A International's franchising program is not offered to individuals or entities located in the United States.

The franchising program is offered by MergersUK Limited, a UK Company with its registered office at 71-75 Shelton Street, Covent Garden, London, WC2H 9JQ, United Kingdom.

MergersCorp M&A International provides strategic business advisory services, including preparing companies for growth and capital access. Through partnerships with licensed investment bankers, clients can access tailored capital-raising solutions.

U.S. Investment Banking Securities transactions are exclusively conducted by Spektrum Capital Advisors LLC, a Registered Representative of, and Securities Products offered through, BA Securities, LLC, a FINRA-registered broker-dealer. Check the background of investment professionals associated with this site on Broker Check.

This website is operated by MergersUS Inc a US Corporation with registered office at

40 Wall Street, Suite #2725, New York, New York 10005, United States of America

Security Verification

For security purposes, please solve this simple puzzle to verify you are human before sending an OTP.

Description

This represents the opportunity to acquire a world-leading, innovative manufacturer of high-precision machinery for the hygiene and medical sectors. Based in the Swiss, the company specializes in complete infrastructure for tampon and wound care production, supported by over six decades of industry expertise.

The company is a specialist in highspeed nonwoven converting systems, serving the medical, pharma, life science, and hygiene industries. It acts as an end-to-end solution provider by covering the entire value chain:

Machinery: Production of state-of-the-art tampon and wound care machines featuring high throughput and low waste.

After-Sales & Services: Comprehensive support including planning, installation, maintenance, repairs, and training.

Parts & Digital: Provision of spare parts and evolving digital services to ensure long-term client partnerships.

Market Position & Competitive Advantage

Global Leadership: Recognized as a niche world leader with a track record of delivering high-quality production solutions for over 60 years.

Innovation Excellence: Maintains a highly skilled workforce with a significant focus on Research & Development.

New Technology: Recently developed the TMX machine, a highly efficient system designed to significantly boost productivity.

Client Base: Diversified portfolio including private label manufacturers and significant potential for OEM partnerships.

Market Opportunity

Market Growth: The global tampon market is valued at over USD 1.5 billion, with an expected CAGR of 4.75%, reaching USD 1.9 billion by 2027.

Growth Drivers: Demand is fueled by global population expansion, increased emphasis on personal hygiene, and rapid growth in emerging markets.

Strategic Expansion: The company is well-positioned to leverage its international network to capture increased demand in these growing markets.

Basic Details

Target Price:

CHF 10,000,000

Gross Revenue

Fr.10,000,000

EBITDA

Fr.2,000,000

Business ID:

L#20260974

Country

Switzerland

Detail

Similar Businesses

Published on January 5, 2026 at 8:32 pm. Updated on January 5, 2026 at 8:40 pm

30-Year-Old Historic company producing make-up stations and illuminated mirrors

TBD

Manufacturing

54-Year-Old Screws & Rivets Manufacturing Company

TBD

Manufacturing

30-Year-Old Historical Italian Packaging Filling Machine Manufacturing Business

€3,100,000

Manufacturing

Manufacturer of Aluminum Profile

$60,000,000

Manufacturing

Business Specialized in the Production and Sale of PVC Ornamental Panels

€10,087,000

Manufacturing

Innovative and Sustainable Packaging Manufacturer

€4,950,000

Manufacturing

PREVIOUS PROPERTY

Digital-First Global Luxury Jewelry Platform Business

NEXT PROPERTY

Next Generation Quantum Native Financial Infrastructure (Patent Pending)